CASUAL TAXABLE PERSON

Meaning

As per Sec 2(20) of CGST Act, 2017” Casual taxable person” means a person who occasionally undertakes transactions involving supply of goods or services or both in the course or furtherance of business, whether as principal, agent or in any other capacity, in a State or a Union territory where he has no fixed place of business”

ELIGIBILITY CRITERIA FOR CASUAL TAXABLE PERSON

Frequency of Transaction are undertaken Occasionally i.e., non-recurring in a state or UT

No fixed Place of Business in that State or UT.

CTP registration will be required only if Transaction amounts to Supply i.e. supply of Goods, Services or both.

Transactions have been undertaken in the other State in the course or furtherance of his Business.

Person undertakes transaction whether as Principal or Agent where they do not have filed place of business.

RETURNS UNDER CASUAL TAXABLE PERSON

| FORM NAME | DUE DATE | MEANING |

| GSTR-01 | 11th of the following month | Details of Outward Supply of Goods and Services |

| GSTR-3B | 20th of the following month | Summary of ITC Claimed, Purchases and Tax liability |

Further, if CTP chooses QRMP scheme, he has to file GSTR-1/IFF and GSTR-3B on a quarterly basis.

There is no Annual Return Form for Casual Taxable Person.

REGISTRATION OF CASUAL TAXABLE PERSON

Casual Taxable Person must compulsory take registration at least 5 days before the commencement of business.

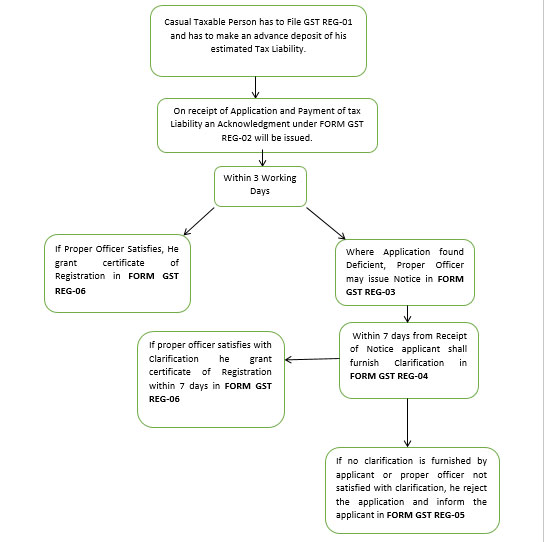

PROCEDURE OF REGISTRATION OF CASUAL TAXABLE PERSON

VALIDITY OF REGISTRATION

The certificate of registration shall be valid for:

• Period specified in the application for registration or

• 90 days from the effective date of registration,

Whichever is earlier.

Frequently Asked Questions

Business/Trade Name along with Copy of Incorporation Document evidencing the Existence of Document. (E.g., PAN Of Applicant, Partnership Deed, Company Incorporation Certificate).

Mobile Number and E-Mail ID for communication and OTP purpose.

Bank Details (Cancelled Cheque or Copy of Pass Book or Bank Statement).

Details of Partners/Promotors/Directors along with their Address Proof.

Details of Nature of Business to be carried out by the applicant along with Details of Principal place or Additional Place of Business (if Any) in the state with their Address Proof.

Existing registration of the applicant if any

Authorization letter provided on the applicant’s Letterhead to authorize one or more persons for signing all documents related to GST. (Provided it is not required in case of Proprietorship)

ANS A CTP may apply for extension of validity period of registration and proper officer may extend the validity period of said period of 90 days by a further period not extending 90 days on the basis of sufficient cause shown by registered person.

Provided registered person has to file Form GST REG-11 before the end of validity of registration along with payment of additional amount of Tax equivalent to estimated Tax liability for the period for which extension is sought.

ANS There is no specific provision mandating CTP to apply for Cancellation of Registration as on completion of validity period, the status of Registration gets automatically converted to “INACTIVE”.

However, CTP may surrender its registration at any time as desired.

ANS If CTP have Multiple Business verticals in a state, then he applies for Multiple Registration within the state.