GST AUDIT

As per sec. 2(13) of CGST Act 2017, Audit Means

Examination of Records, Returns and Other Documents furnished by Registered Person

To verify the correctness of Turnover Declared, Taxes Paid, Refund Claimed, and ITC availed.

To access compliances under the provision of this Act.

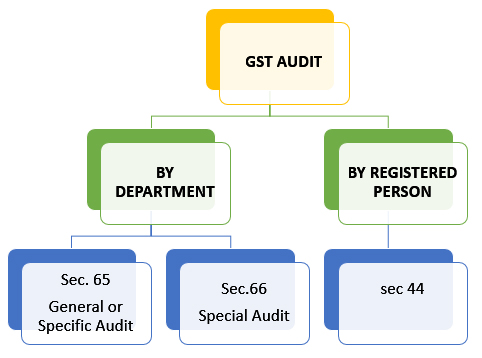

TYPES OF AUDITS UNDER GST

AUDIT BY REGISTERED PERSON

As per Sec 44 of the CGST act if the Aggregate Turnover of Registered Person exceeds Rs. 2Cr then registered person is required to file a reconciliation statement under GSTR 9 and if Turnover Exceeds 5Cr. then along with GSTR 9, he has to submit a self-certificate under GSTR 9C. Let us under this with the help of Table-

Table showing Applicability of GST AUDIT

| PARTICULAR | GSTR 9 | GSTR 9C |

|---|---|---|

| Aggregate Turnover less than 2CR. | ||

| Aggregate Turnover greater than 2Cr. but less than 5Cr. | ||

| Aggregate Turnover greater than 5Cr. |

WHY GST AUDIT?

Prepare the Registered persons in a better way in facing departmental Audit.

Helps in Facing Litigation which may come at a future date.

Provides control so that all the provision of GST is applied in the appropriate way.

Helps in Reconciliation of Outward Supply and ITC was taken.

HOW TO CONDUCT TAX AUDIT

1) TURNOVER RECONCILIATION (MATCHING OF GSTR3B WITH AUDITED BOOKS)

Turnover must be matched as per GSTR 3B and books of accounts

Verification of Place of Supply to check whether correct GST is charged (Especially in “Bill to Ship To model”

Examine whether Value of Supply is correctly Ascertained as per sec 15 of CGST Act.

Examine correct tax rate is applied as per HSN.

Exempted supply and Export should be properly disclosed in Returns.

2) ITC AVAILED

Provision of Sec 17(5) must be kept in mind and checking whether blocked credit is reversed or not.

Reconciliation must be done for ITC availed on expenses as per P&l account.

Reversal of ITC in case where payment to creditors is not made within 180days.

Reversal of ITC in case of Sale/Transfer of Capital asset.

3) REFUNDS CLAIMED

Examine the outward supply shown as export must comply with the provision of FEMA. Further refund has been claimed as the provision of the Act

Proper documentation must be checked in case of refund claimed in case of Inverted Tax Structure.

4) OTHER COMPLIANCES

Ensure Tax invoices, Debit or Credit notes, Payment or Refund Vouchers are properly issued and are in order

E-Way bill must be issued in case of the value of goods is more than Rs.50000 and in case of inter-state supply even if the value of goods does not exceed Rs. 50000.

All Registered places of supply must be disclosed in the GST portal.

GST AUDIT BY DEPARTMEN

As GST is self-assessment tax where tax liability is duly determined, calculated, and deposited by a taxpayer. In order to measure the level of compliance of taxpayers in light of provision and rules of the CGST Act and to facilitate the tax administration’s aim of getting "the right tax at the right time department may conduct an audit of the taxpayer.

Sec 65 Specific or General Audit

Commissioner or any other the officer authorized may conduct an audit of any taxpayer by general or specific order.

Before commencement of audit, the taxpayer must be given 15 days prior notice.

Audit may be conducted either at the principal place of business or at his office.

Audit must be completed within a time period of 3 months from the date of commencement but the commissioner may extend the period for a period not exceeding 6 months.

If the Audit results in the deduction of taxes not paid or short paid or erroneously refunded, tax credit wrongly availed or utilized, the proper officer initiates action u/s 73 & 74.

Sec. 66 General Audit

During any stage of inquiry, scrutiny or investigation were due to complexity of cases and interest of revenue where value has not been correctly declared or credit availed is not within normal units.

Officer not below the rank of commissioner direct such person to get his books audited by Chartered Accountant or Cost Accountant.

The auditor so appointed shall submit his report duly signed by him within 90 days to such commissioner which may further extend for a period of 90 days for any material and sufficient reason on an application made to him by the registered person or Chartered Accountant or Cost Accountant.

The registered person will be given the opportunity for being heard

If the Audit results in the deduction of taxes not paid or short paid or erroneously refunded, tax credit wrongly availed or utilized, the proper officer initiates action u/s 73 & 74.

Frequently Asked Questions

List of documents that are mandatorily required to be checked during GST Audit-

• GSTR1, GSTR3B copy of all the relevant documents of the audit period.

• Reconciliation of

• Audited Sales figure with outward supply declared in GSTR1 & GSTR3B

• ITC availed with GSTR 2b

• GST reconciliation Statement in form GSTR9

• Trail balance or its equivalent

• Audited statement of annual financial account

• Cost Audit Report if required u/s 148 of company act.

• Tax Audit Report if applicable

• Possession of tax invoices in order to claim ITC

• Invoice of supply attracting RCM

• Bill of Supply

• Refund Voucher

• Payment Voucher

• Delivery Challan

• Names and complete address to whom goods are sold and from whom goods are purchased.

• other Relevant documents such as

• sales Register

• Purchase register

• store ledger

• Job work/ sub-contract ledger

• Monthly stock statement to a bank

• Debit note

• Credit note

• Fixed Asset register

• Journal Voucher

• Ledgers

• Purchase Return