TRADE MARK

Trade Mark is a recognizable sign, design or expression which separates a goods and services of an enterprise and distinguishes it from goods and services of other enterprises.

Trade Mark can be a text, phrase, symbol and/or color scheme.

PROCESS OF REGISTRATION OF TRADEMARK

The registration process of Trade Mark is based on First to File Basis. It is governed by the office of Controller general of patents, Trademarks, Industrial design and Geographical Indications.

Visit ipindia.gov.in

Then create your Login Credentials using DSC –In this process basically you have to check the name availability.

After getting name, you have to select Type of Applicant, under applicant there is three option available namely,-Proprietor, Agent& Attorney.

After successfully creating login credentials you will get your code.

After that you are eligible to File Form TM-A

Under Form TM-A, you have to choose class of Business and to describe the goods and services description.

• Under Trade Mark act there are total 45 classes out of which 1 to 34 belongs to Goods and 35 to 45 belong to services.

After proper filling of TMA Form with PDF of required attachment, we are required to file the TMA by affixing the DSC of the Owners /Advocate /Agent.

Then you have to pay Requisite fees payment.

Documents Required While Filing Form TM-A

INDIVIDUAL OR SOLE PROPRIETOR

Pan Card/Aadhar Card

Sign Form TM-A

GST CERTIFICATE (If GST Certificate is taken in its name then it must be used )

Other Documents(Electricity Bill, Gas Bill, Bank Statement)

Trade Mark description – Description of Goods and Services.

PARTNERSHIP FIRM

KYC of all Partners such as Pan Card, Aadhar Card.

Trade Mark description – Description of Goods and Services.

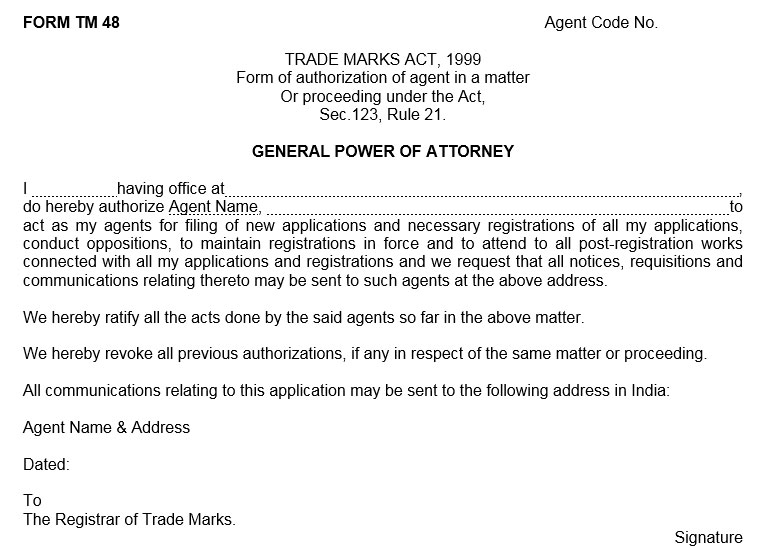

Form TM-48A (Power of attorney)

GST CERTIFICATE (If GST Certificate is taken in its name then it must be used )

COMPANY

KYC of all Partners such as Pan Card, Aadhar Card.

Trade Mark description – Description of Goods and Services.

Certificate of Incorporation

Form TM-48A (Power of attorney)

GST CERTIFICATE (If GST Certificate is taken in its name then it must be used )

The fees for filing Trade Mark Application is as follows:

| PARTICULAR | FEES |

| INDIVIDUAL/SMALL ENTERPRISE Provided Small enterprises applicant must present Udyog aadhar registration certificate in order to classify themselves as Small enterprises. |

4500.00 |

| IN ALL OTHER CASES | 9000.00 |

Further note that fees is for each class and for each mark.

GROUNDS FOR OPPOSITION OF TRADE MARK

Trade Mark is such a nature as to deceive the Public or cause confusion

Trade Mark comprises of matter that hurt the religious sentiments of any class of people

Trade Mark is not capable of distinguishing the goods or services of one person from other

Trade mark contains scandalous or obscene matter.

PENALTY FOR APPLYING FOR FALSE TRADEMARK

| PARTICULAR | MINIMUM | MAXIMUM |

| Imprisonment | 3 Months | 3 Years |

| FINE | 50,000.00 | 2,00,000.00 |

IMPORTANT FORMS UNDER TRADEMARK

| FORM NO. | USE OF FORM |

| TM-R | For Renewal of Trade Mark Application. |

| TM-P | For Registration of Subsequent proprietor in case of assignment or transfer for each trademark. |

| TM-C | Request for Search and Issue of Certificate to the effect that no trademark identical with or deceptively similar to such artistic work, as sought to be registered as copyright |

| TM-G | Application for registration of a person as a trade mark agent |

Frequently Asked Questions

Ans Trade Mark Act enables registration of a trade mark of two or more persons as Joint Proprietors.

AnsTrade Mark is valid for 10 Years and is to renewed every 10 years perpetually

• Goods are classified on the basis of Finished Goods function and purposes. Similarly if Finished good is not mentioned then it is compared with other finished product.

• Services are classified based on activities specified in the service classes.

For Goods

| CLASS 14 | Precious metals and their alloys and goods in precious metals; jewellery, precious stones; horological and other chronometric instruments |

| CLASS 15 | Musical instruments |

| CLASS 24 | Textiles and textile goods, not included in other classes; bed and table covers. |

| CLASS 25 | Clothing, footwear, headgear |

| CLASS 34 | Tobacco, smokers' articles, matches |

For Services

| CLASS 35 | Advertising, business management, business administration, office functions. |

| CLASS 41 | Education; providing of training; entertainment; sporting and cultural activities. |

| CLASS 45 | Legal services; security services for the protection of property and individuals; personal and social services rendered by others to meet the needs of individuals. |

Will be printed on Rs 100 NON JUDICIAL STAMP PAPER WITH NOTARIZED