OPC COMPANY FORMATION

What is ONE PERSON COMPANY?

•As per Section 2(62) of the company’s Act 2013 a company can be formed with one director and who will be the sole member of OPC with Minimum authorized capital of ₹ 1 lakh.

•OPC Company cannot be incorporated or converted into a company under section 8 of the companies Act 2013. It cannot carry out non-Banking financial Investment Activities including investment in securities of any Body Corporation.

To conclude, One Person Company means one individual who should be a resident can start his/her business that has features of both a company and sole proprietorship.

Eligibility to be a member of ONE PERSON COMPANY

• A natural person (i.e., one who has its own legal personality) who is an Indian citizen and resident in India: -

a. Shall be eligible to be a member of One Person Company,

b. Shall be a nominee for the member of one Person Company,

c. “Indian citizen” means a person who has stayed in India for not less than 182 days in the immediately preceding financial year.

•The memorandum of One Person Company shall indicate the name of nominee who shall in the event of the member’s death or his incapacity to contract become the member of the company.

•The nominee can withdraw his/her consent anytime. The member may anytime change the name of the nominee by giving notice to the company and the same shall be intimated to the registrar in form INC 4 and the name of another nominee shall be filed in form INC-3

•No minor shall become member or nominee of a one person company.

•A natural person shall not be a member of more than one” One person company” and the said person shall not be a nominee of more than one OPC.

ADVANTAGE OF A ONE PERSON COMPANY:

1. Limited Liability: Since the liability of the members is limited to the extent of value of shares.The individual can take more risk in business without stressing or suffering the loss of any personal assets. It is a type of encouragement to new, young and innovative business start-ups.

2. Easy to obtain funds: It can raise funds using venture capital, angel investors, financial intuitions etc.

3. Less compliances: The OPC is not require to prepare the cash flow statement. The company secretary need not sign the books of accounts and annual returns to be signed only by the director.

4. Easy to manage: : only one person is present to operate the business therefore it becomes easy to manage the affairs of the business and doesn’t lead to delay or work.

As of the data of December 2020 there are 34235 OPC’s out of 1.3 million active company.

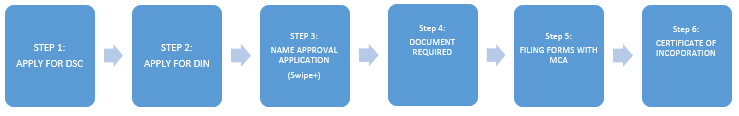

STEPS FOR INCORPORATION OF ONE PERSON COMPANY:

STEP1:

APPLY FOR DIGITAL SIGNATURE CERTIFICATE (DSC):

Documents required for applying DSC of the Director:

• ADDRESS PROOF

• AADHAAR PROOF

• PAN CARD

• PHOTO

• EMAIL ID

• PHONE NUMBER

STEP2:

APPLY FOR DIRECTOR IDENTIFICATION NUMBER (DIN)

Documents required for applying DSC of the Director:

• APPLY FOR DIN IN SPICE FORM ALONG WITH NAME AND ADDRESS PROOF OF DIRECTOR.

• FORM DIR 3 IS FOR EXISTING COMPANIES. DIR 3 IS NOT NEEDED TO BE FILLED SEPERATELY.

• DIN FOR NEW COMPANIES CAN BE APPLIED WITHIN THE SPICE FORM FOR UP TO THREE DIRECTORS.

STEP3:

NAME APPROVAL APPLICATION (SPICE)

• DECIDE THE NAME OF THE COMPANY IN FORM OF “ PQR(OPC) PRIVATE LIMITED”.

• ONE PREFERRED NAME ALONG WITH THE SIGNIFICANCE OF KEEPING THE NAME SHALL BE FILLED IN SPICE+ 32 FORM.

• IF THE NAME GETS REJECTED FILL SPICE +32 WITH THE MCA AGAIN.

• MCA SHALL APPROVE THE NEWLY INCOPORATED OPC IN 20 DAYS. IN CASEOF CHANGE OF EXISTING NAME THE APPROVAL IS GIVEN WITHIN 60 DAYS.

STEP4:

DOCUMENTS REQUIRED

FOLLOWING DOCUMENTS NEED TO BE SUBMITTED TO MCA:

• THE MEMORANDUM OF ASSOCIATION WHICH CONTAINS THE OBJECT OR STATING THE BUSINESS FOR WHICH THE COMPANY IS GOING TO BE INCORPORATED.

• THE ARTICLE OF ASSOCIATION LAYS DOWN THE BY-LAWS OF THE COMPANY.

• INC-3 (NOMINEE CONSENT FORM) ALONG WITH HIS PAN CARD AND AADHAAR CARD.

• PROOF OF REGISTERED OFFICE, PROOF OF OWNERSHIP AND A NOC FROM THE OWNER.

• DECLARATION OF THE PROPOSED DIRECTOR INC-9.

• CONSENT OF THE DIRECTOR PROPOSED IN DIR- 2.

• DECLARATION BY THE PROFESSIONAL THAT ALL THE COMPLIANCE HAVE BEEN MADE.

STEP5:

FILING OF FORMS WITH MCA

• SPICE FORM.

• SPICE-MOA.

• SPICE-AOA.

• DSC OF THE DIRECTOR AND PROFESSIONAL.

• NO NEED TO FILE SEPARATE APPLICATION FOR OBTAINING PAN NUMBER AND TAN.

STEP6:

CERTIFICATE OF INCORPORATION

• ON VERIFCATION THE REGISTRAR OF COMPANIES (ROC) WILL ISSUE CERTIFICATE OF INCORPORATION IN INC-11 IN 3-5 DAYS.

• AFTER RECEIVING INC -11 WE CAN COMMENCE OUR BUSINESS.

COMPLIANCES ONE PERSON COMPANY NEED TO FOLLOW:

An Exclusive Name

1. Maintain proper books of accounts.

2. Statutory audit of financial statements.

3. Filing of income tax returns.

4. Filing of financial statement in form AOC-4 and ROC Annual Return in Form MGT 7.

5. At least one board meeting in 6 months and the time gap between two board meetings shall not be less than 90 days.

Frequently Asked Questions

Ans: There is no tax advantage of an OPC. The flat rate is 30%. Other provisions like Mat and dividend distribution tax applies just like any other form of the company.

Ans: Yes, an OPC can convert voluntarily into public/ private coming by passing special resolution and increasing the number of directors.