COMPLETE BOOKKEEPING

OUTSOURCING OF BOOKKEEPING

It is generally said that the accounts department of any company is the lifeline of the business. However, the same is not found in real life. The accounts department is considered to be occupied with only the recording of historical transactions of the organization.

The top management of the company is more focused on the sales department or the marketing department, which are the revenue generating departments of the entity. More often than not the administrative department like the accounts department are neglected. Let us look at the various ways in which the accounts department is a boon to the entire organization and serves as an essential thread that binds the entire organization together:-

Tracking of the production record by the sales team

Let us have a look at a scenario where the sales team of the organization has bagged a huge deal from the leading customer in the area. However, while fulfilling the order, they got the shock of their life when they came to know that the production department has not produced that many quantities yet. As such the demands could not be met on time and the reputation of the company was about to be tarnished. The whole fiasco could have been avoided if proper accounting records were kept by the company.

The expected demand in the market

The various accounting ratios of the previous year’s acts as a fundamental tool that helps to forecast the demand of the products. The organisation may keep on producing the goods, which the sales team is unable to sell as the demand of the product has reduced considerably in the market. If proper books of accounts had been kept, such an error of judgement by the management could not have occurred.

Tracking of the expenses and the resulting profitability of the company

If the top management of the company has no way of keeping a track on its expenses, the company would squander away its money on non-value adding services. All of these leads to the lower profitability of the company, and the top management is kept in the dark as there is no way of tracking the same.

In the above points, it has been clearly illustrated how accounting department is a cornerstone in any entity. Accounting not only helps in the planning process but also in the controlling part as well.

What are the benefits of outsourcing?

Now, come the question how the entity can focus on its core activities as well as maintain an accounting department. The answer is quite simple, just outsource the accounting work to a competent organization who is having descent experience in the same. You can check out the services offered at helpmybiz.

Many small business houses, MSMEs (Micro Small and Medium Enterprises), various professional like doctors, engineers, architects, interior decorators find it challenging to hire a full time accountant. Often the accountants lack the proper skill set to prepare the financial statements, manage banking operations, prepare the invoices and analyse financial data. Let us look at the seven benefits of outsourcing the accounting services:-

Cost saving

Outsourcing the accounts work help reduce the expenses compromising its quality. Besides, outsourcing reduces the salaries, taxes, office supplies and several other benefits which have to be extended to the full time and the part time employees.

Eliminate the cost and time of hiring process

The recruitment process is a rigorous job which demand huge resources to manage it. The time required has to be considered as opportunity cost lost and this has to be compared with the cost of outsourcing the operation.

Saving your time-

As your business grows, more of your time should be focused on increasing the quality of your products and services. Therefore, by outsourcing the administrative tasks like accounting and bookkeeping, you can focus your energy on building business strategies and scaling your business

Expert accountants and bookkeepers

Outsourcing offers you the possibility to hire skilled accounts with higher level of expertise at affordable rates. Moreover, outsourcing your work to an accounting firm, gives you access to a team of accountants. As such, the specific expertise of the accountants at their respective fields can be availed.

Scaling accounting easily

As your business grows, so does your accounting department. As such outsourcing gives you peace of mind that you don’t have to recruit additional people in accounting department.

Automation technologies

Most organizations use software to reduce the element of human error in bookkeeping. Most of the accounting service providers are highly qualified in the automation tools like tally, QuickBooks, genesis, SAP, Microsoft Office Suits and the like.

Accountant can be your advisor

A good accountant always provides you with quality insights in your organization. He also advises you on how to make the accounting function more efficient.

What are the basic advantages of accounting?

Maintenance of permanent business records-

businesses have huge financial transactions. Accounting helps in recording all the financial transactions pertaining to the respective year

Systematic order

it is a systematic representation of business transactions. Accounting keeps a record and analysis of various business transactions undertaken by the entity.

Helps in raising loans

business houses raise loans to expand their business operations. Loans are generally granted on the basis of the profitability of the business and the stock in hand. Banks grant loan based on the profitability of the company.

Complying with law

a business has to comply with various statutory dues and obligations like GST, PF, ESI, TDS etc. Proper accounting ensures that such statutory compliance is proper and completed on time so that no complications arise in the future.

Cost control

Accounting helps to keep a track on the expense of the organization, as such the profitability of the organization depends on the same.

Decision making through accounting ratios

it helps in the prevention, correction and detection of frauds.

Prevention of frauds and forgery

As already stated above, accounting plays a fundamental and key role in decision making. Key ratios like EBITDA (Earnings before Interest, Tax, Depreciation and Ammortisation) ratio, GP(Gross Profit) Margin ratio, NP(Net Profit) margin ratio, ROI (return on investment), Debt-Equity ratio and various other ratios can only be calculated if proper accounting data is maintained for the past years. These ratios form the basis for several important decision making in the entity like how much of the loan is to be raised, what is the return on investment, how much more revenue is to be generated so as to reach the target GP/NP ratios.

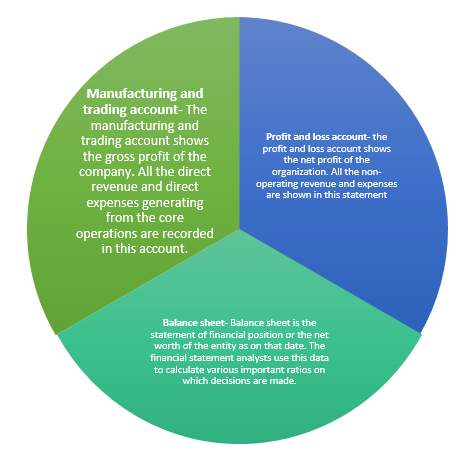

What are the different type of final accounts?

An accountant not only maintains your books of accounts but also helps in fianalisation of the financial statements of the entity. So what comprises of the financial statements of the entity. These include:-

What are the 5 important things to look before outsourcing?

You should choose an outsourcing company which is a perfect fit for your goals and objectives, but it should also match with your needs and requirements. Few essential factors to be considered are:-

What are the services that you need

Do you need to prepare month end reconciliations, payables, receivables or day to day accounting. Whatever it may be, you have to be very clear about the services that you require.

Competitive cost range

Every firm has its own method of charging its clients. Some of them charge monthly while some on hourly basis. You should choose the payment terms that meet your need and budget, but the decision should not be solely on the basis of cost-effectiveness.

Expertise

Choose an organization that has experienced professionals in its team. Always take care of the accounting firm’s reputation and brand image in the market.

Data Security

data security forms an essential part while choosing an accounting services online. Firms with high reputation handles the client’s with utmost care and ensures highest levels of security and privacy. It is essential because some confidential data might also be sent along with regular data. At help my biz, we take your data security very seriously. Full confidentiality and privacy of your data is ascertained if you come on board with us.

Check the contract before you sign

it is advisable to read the contract carefully before signing it as you should have the option to terminate the contract if the work performed by the accounting firm does not suit your needs. A proper contract of confidentiality is signed beforehand at help my biz before such service is undertaken. We are as much concerned with the privacy and confidentiality of your data as you are and hence such contract is entered.

CONCLUSION

To conclude, there are various benefits which are available if a company decides to outsource its accounting function. Accounting and bookkeeping are without doubt vital part of an organization but at the same time it is quite complex as well. It requires time and specific knowledge with prior accounting experience. If accounting and finance departments are neglected, it may lead to complications in the future like demands from tax authorities, penalties, degradation of reputation etc.

We, at help my biz, have been providing accounting services to several of our clients for over 22 years, spread across India like Kolkata, Mumbai, Chennai, Delhi, in various sectors like Hospitality, Iron and Steel, Textiles and various other manufacturing and service concerns. We have a competent team of professionals with years of experience. We ensure that your data is safe and sound in our hands, so that you can rest assured about the accounting part of your organization.

Frequently Asked Questions

Ans. It reduces the cost of business, can easily scale up when your business increases, reduces the headache of payroll responsibilities and frees up time to focus on core business areas.

Ans. You may lose some control, data privacy issues, hidden costs, security risks etc.

Ans. The common methods are:-

• Hourly rate- most common way

• Fixed fees- another popular method. Time and cost are calculated beforehand for a particular project and then a markup is added on the cost

• Value price- this is similar to fixed price. The client is charged on the basis of value addition.