INCOME TAX NOTICES

Notices under the Income Tax Act, 1961

After a taxpayer files their Income Tax Return, it shall be processed by the Income Tax Department. If there is any mistake/error/discrepancy noticed in the income tax return filed, then through the income tax notice, it shall be intimated to the assessee.

Why is an income tax notice issued?

A notice may be issued for the following reasons:-

IT Return has not been filed

Mistakes/Discrepancies in the return filed

TDS mismatch between the return filed and 26AS

Any transaction shown in the ITR but does not match with the department records

Assessing Officer requires some documents or details

Scrutiny to be carried out under 143(3)

For any other purpose as the AO deems fit.

There 7 types of income tax notices are given below:-

Section 139(9): Defective Income Tax Return

Assessing officer is of the opinion that the ITR filed by the assessee is defective. A proper description of the error along with the possible solution is shared by the Assessing officer. 15 days are provided to the assessee to respond to the notice.

Section 131(1A): Income is concealed or likely to be concealed

If the assessing officer is of the opinion that the income has been concealed or is likely to be concealed then you will receive a notice u/s 131(1A). The notice is an intimation of the initiation of an enquiry or investigation into the matter by the AO. The AO has the power to impound the books of accounts and documents by providing reasons for the same.

Section 142(1): Preliminary Enquiry before an assessment

A notice of preliminary enquiry is served if the income tax return is not filed on time. Also, if the AO wishes to go through the documentary proof, he may serve this notice for assessment purposes. The time limit to serve this notice is before the end of the relevant assessment year.

Section 143(2): Follow up to the notice u/s 142(1)

If the AO is not satisfied with the response of the assessee or the assessee fails to provide the documents, as explained in the previous point, then you may receive a notice under section 143(2). The time limit to serve the notice is before the end of the six months from the end of the financial year

Section 148: Income escaping assessment

If the new assessing officer does not agree with the previous assessing officer, then you can expect a notice u/s 148. In other words, even when your assessment has been completed, but still the AO feels that your income has escaped assessment, then a notice u/s 148 can be issued. The assessee may need to file the income tax return for the relevant assessment years.

Generally notice u/s 148 can be issued within 3 years from the end of the relevant assessment year, but if-

a) Income escaped amounts to Rs 1 Lakhs or more, the notice can be issued up to 6 years, from the end of the relevant A.Y.

b) If income relates to foreign assets, then notice can be issued up to 16 years from the date of the relevant assessment year.

(Applicable only till 31/03/2021)

Section 156: Notice of Demand

If any penalty, fine, tax or any other amount is due from the taxpayer then notice under section 156 is served. This notice is normally issued after the ITR has been served. The taxpayer will have to pay the amount within 30 days from the date of the notice. No time limit has been prescribed to serve this notice

Section 245: Refund adjusted against the tax demand

This notice is issued when the tax demand is adjusted against the tax refund for an assessment year. There is no time limit to serve this notice.

The objective of this write-up is to provide the taxpayers with a basic overview of the various notices issued by the tax department. Some of the sections are a complete subject in themselves.

A common point where taxpayers get confused are the income tax notices and the assessment intimations. If you receive intimation under section 143(1), 147, 143(3) or 144 then these are not income tax notices.

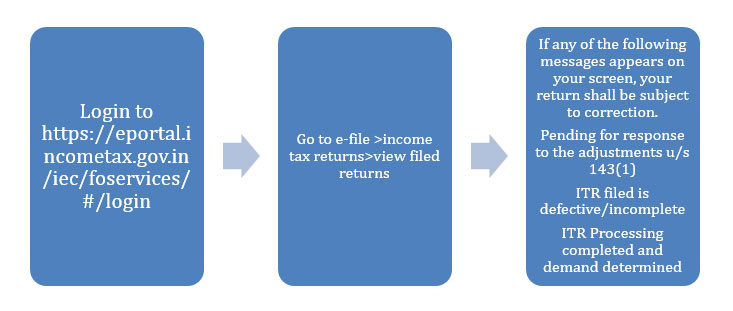

How to check whether there is a notice to me or the status of the notice issued?

The stepwise process to check the notices issued to you are as follows:-

Service of Income Tax Notice

The income tax department has laid down the law for the service of a notice, summons, orders etc. The following ways in which the notices are issued are given below:-

Recipient of Notice

notice is directly addressed to the individual

Service by post

Notice can be served through a registered post.

Service by affixture

In case the assessee refuses to sign the acknowledgement, a copy of the notice is fixed on the outer door or any other part of the assessee’s residential premise.

HUFs and Partnership Firms

In case the HUF is completely dissolved, the notice may be issued on the person who was the manager of the HUF. In case of Firms, notices are issued to the former partners.

Closed businesses

In case of proprietorship business, notice is issued to the proprietor. In case of partnership firms or Association of persons, notice is issued to any of the members who have been a part of the firm during discontinuation. In case of a company, the notice will be served on the principal officer or the director.

Frequently Asked Questions

Ans. Yes, more than one Income tax notice can be issued during the year. For example, you may receive an intimation u/s 143(1) upon which you filed the correct ITR. But later, during the same year you may receive a notice u/s 154 demanding further clarification. Hence, more than one notice may be issued during the year.

Ans. It is suggested that Income tax notices are not ignored. Ignoring the notices may attract penal provisions under the income tax act.

Ans. There is no fixed time limit. It would depend upon several factors like the time taken to process the return, the response by the assessee etc.

Ans. When AO takes the view that the assessee is concealing income in his ITR, then he will receive such a notice. This notice is just an intimation that the AO is initiating the enquiry or investigation.