TDS RETURN FILING

TDS ON INCOME TAX

What is TDS (Tax Deducted at Source)?

TDS is one of the important areas in income Tax. Through TDS, a portion of the tax is paid directly to the Income Tax Department.

What is TAN ? (Tax deduction Number)

TAN is a mandatory 10 digit alphanumeric code that is to be obtained by all the people and entities who are responsible for deduction of the tax. Salaried individuals are not required to deduct TDS or obtain a TAN number.

In case of corporate and non-corporate entities, TDS is required to be deducted while making certain payments like salary, payment of rent exceeding Rs. 2,40,000 p.a., payment to contractors etc. Helpmybiz can help in obtaining the TAN Registration.

TAN is a mandatory 10 digit alphanumeric code that is to be obtained by all the people and entities who are responsible for deduction of the tax. Salaried individuals are not required to deduct TDS or obtain a TAN number.

Entities having valid TAN are required to file TDS returns quarterly. Our TDS experts can help in the computation of TDS and ensure compliance with the various TDS rules and regulations.

Eligibility Criteria

Any person making a specified payment mentioned under the income tax act is required to deduct the TDS and are required to deposit the tax to the government within the stipulated due dates. The different types of payments include:-

Salary payments

Commission and brokerage

Professional fees

Income on securities

Income by winning of lotteries, puzzles and others

Insurance commissions and several other schemes

What are the due dates for the TDS return filing?

The due dates are divided into two parts.

First, is the due date for the payment of the TDS amount to the government. The 7th of next month is the due date.

Second are the TDS return due dates. The TDS returns contain the entire details of the parties along with their PAN number, address etc. which are to be filed quarterly.

The table below shows the due dates for the filing of the TDS returns

| Quarter | Period | Last Date of Filing |

|---|---|---|

| 1st Quarter | 1st April to 30th June | 31st July 2021 |

| 2nd Quarter | 1st July to 30th September | 31st October 2021 |

| 3rd Quarter | 1st October to 31st December | 31st Jan 2022 |

| 4th Quarter | 1st January to 31st March | 31st May 2022 |

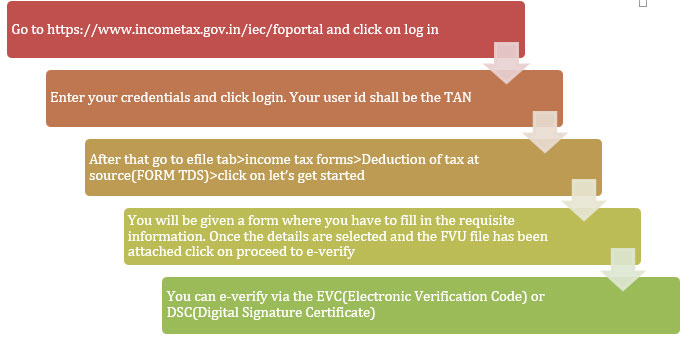

The process for filing TDS return on the income tax website is given below:-

What are some of the important TDS provisions for the FY 2020-21?

| Section | Source of Income/Expense | Threshold limit | TDS Rate (%) |

|---|---|---|---|

| 192 | Payment of salary income | As per the Income Tax Slab | As per the slab |

| 194A | Interest payment other than interest on securities like interest on bank deposits, interest on loan and deposits etc. | Rs. 10,000 in case the TDS payer is the bank or any banking institution Rs 5,000 in any other case | 10% |

| 194C | Payments made to contractor and subcontractor | Rs. 30,000 for single payment and Rs. 1,00,000 for annual payment | ● 1% for individual and HUF ● 2% for others |

| 194J | Payment of royalty, technical or professional services | Rs 30,000 | 10% |

| 194H | Payment of commission or brokerage | Rs 15,000 | 5% |

| 194I | Payment of rent for use of land building/furniture or fittings Payment of rent for use of plant and machinery |

Rs 2,40,000 Rs. 2,40,000 |

10% 2% |

| 194N | Annual cash withdrawal from all accounts with a bank/co-operative society/post office | Rs. 1,00,00,000 | 2% |

| 194IA | TDS on purchase of immovable property | Rs 50,00,000 | 1% |

| 194K | TDS on income in respect of units of Mutual Fund | Rs. 5,000 | 10% |

| 194Q | Buyer, paying any sum to a resident seller for purchase of goods | Rs. 50,00,000 | 0.1% |

What are the different forms of TDS?

TDS forms depend on the type of deductee paying the tax or the income of the deductee. The forms are mentioned below:-

| Forms | Periodicity | Particulars | |

|---|---|---|---|

| Form 24Q | Quarterly | Statement for “Salaries” | |

| Form 26Q | Quarterly | Statement for “other than salaries” | |

| Form 27Q | Quarterly | Statement of TDS from payments made to non-residents | |

| Form 27EQ | Quarterly | Statement for collection of TCS |

What is a TDS Certificate?

TDS certificate will be furnished after the TDS is deducted by the deductor. The deductee has the option to cross-check the tax credit by viewing a valid TDS Certificate from the TRACES (TDS Reconciliation analysis and correction enabling system) website containing a unique 7 digit watermark and a TRACES Watermark.

TDS certificates for other than salaries are issued every quarter, while TDS certificates for salaries are issued on an annual basis.

In case the deductee loses the possession of the certificate a duplicate TDS certificate can be requested.

What is the Penalty for failure in the TDS Return?

If the assess fails to file the TDS return before the due date, a penalty of Rs 200 per day under section 234E,shall be paid by the assessee until the time the default is continuing.

If the TDS return has not been filed within a year from the due date or if incorrect information has been furnished then he or she is also liable for penalty. The penalty shall not be less than Rs 10,000 and more than Rs. 1,00,000.

Also, if TDS is not deducted and paid before the due date of return filing, then 30% of the sum payable shall be disallowed as business expense u/s 40(a) (ia)

Can TDS Returns be Revised?

TDS returns once submitted can be revised if errors are detected like incorrect challan details or the PAN is not provided or incorrect PAN is provided then the correct amount shall not be reflected in the FORM 16A or FORM 26AS. Revised TDS return has to be filed if the correct amount is to be reflected in the above mentioned forms.

Prerequisites for submission of Revised TDS Return

Revised return can only be filled when the original return has been accepted by the TIN System. The status of the TDS Return can be checked by the assessee by providing the required details like PAN and the provisional receipt number/token number from NSDL.

How to claim the TDS amount deducted?

The TDS amount that has been deducted can be claimed while filing the income tax return. If the Tax payable is more than the TDS amount deducted, then then there will be an amount payable for the assessee. On the other hand, if the TDS amount deducted is more that the Tax Payable amount, then the assessee will be eligible for refund by the income tax department.

Frequently Asked Questions

Ans. Yes, as per Section 194IA, TDS is required to be deducted at the rate of 1% if consideration is more than Rs 50 Lakhs.

Ans. Yes, 30% of the sum payable shall be disallowed if TDS is not deducted and paid before the due date of return filing u/s 139(1).

Ans. The employer deducts TDS on the employee's salary at the average rate of income tax. The estimated total income of the employee is calculated beforehand, and when it is divided by 12 months, the TDS to be deducted every month can be easily calculated.

Ans. If assessee fails to file the TDS return before the due date, a penalty of Rs 200 per day under 234E, shall be paid by the assessee until the time the default is continuing.

If the TDS return has not been filed within a year from the due date or if incorrect information has been furnished then he or she is also liable for penalty. The penalty shall not be less than Rs 10,000 and more than Rs. 1,00,000.