ESIC REGISTRATION

What is Employee state Insurance Corporation?

It is a multidimensional social security scheme that is designed to provide socio-economic protection to employees working in an organized sector.

Benefits of ESIC registration:

ESI ensures that employees are ensured several benefits under the employee state insurance scheme:

- Maternity benefit

- Disability benefit

- Funeral benefit

- Dependent benefit

- Medical benefit

- Old age medical care

Entities Covered Under ESCI

- Shops

- Hotels or restaurant only engaged in sales

- Cinemas which include private threaters.

- Road motor transport

- Newspaper establishments

- Private educational institutions( those run by individual, trustees, societies or other organization)

- Medical institutional ( including Corporate, joint sector, trust, charitable, and private ownership hospital, nursing homes, diagnostic centers, pathological Labs)

- Manufacturing units, trading units, wholesale, warehouse, listed company and unlisted company.

Eligibility for ESIC:

- An organization with more than 10 employee (in some state it is 20 employees) who have maximum salary of Rs. 21000 has to mandatory register itself with the ESCI within 15 days from its applicability.

- The employer needs to contribute an amount of 3.25% of the total monthly salary payable to the employees whereas an employee needs to contribute only 0.75% of his monthly salary every month.

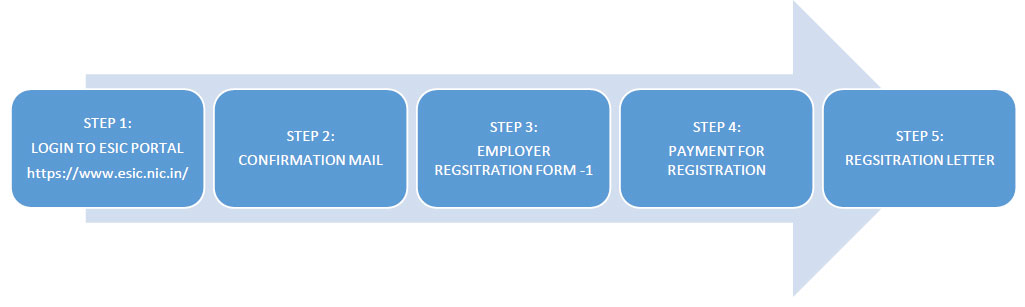

STEPS FOR ESIC REGISTRATION:

DOCUMENTS REQUIRED FOR ESIC REGSITRATION:

Document required are:

- Registration certificate obtained under the following:

- Factories Act, or

- Shops and establishment Act

- Trade license

- Certificate of registration of company, LLP, proprietorship firm, or partnership deed in case of a company

- Memorandum of association and article of association of company.

- Address proof such as the utility bills or rental agreement.

- List of all the employees working in the organization.

- PAN card of the business as well as of all the employees working in the establishment.

- The compensation details of the employees.

- A cancelled cheque.

- List of directors of the company.

- List of shareholder of the company.

- Register containing the attendance of all the employees working.

Compliances after ESIC registration:

- Maintaining the attendance register of all the employees working.

- Maintaining a complete register of wages for workers of the organization

- Inspection book

- Monthly return and challan within 15th of the next month.

- Maintaining a register that records any accident that happened on the premises